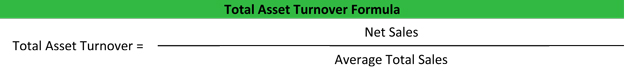

These ratios suggest that Company B is more efficiently using its assets to generate revenue as its asset turnover ratio is greater than Company A’s asset turnover ratio. Inventory Turnover Ratio Cost of Goods Sold (COGS) ÷ Average Inventory. Here’s how the values will appear in the formula:Ĭompany B’s Asset Turnover Ratio = $7 million / $1.5 million = 4.67 The formula used to calculate a company’s inventory turnover ratio is as follows. The higher the ratio, the better the company is at employing its assets. The ratio is calculated by dividing a companys net sales for a specific period by the average total assets the company held over the same period. Investors and stakeholders use the ratio to judge a company’s performance and gauge how much revenue is being generated through its assets. Company B’s average total assets at the end of the year were $1.5 million. The asset turnover ratio depicts how well a company utilise and deploys its assets for every unit of sale. As you can see in the example below, the accounts receivable balance is driven by the assumption that revenue takes approximately 10 days to be received (on average). The next company in the example is Company B with total revenue of $7 million at the end of the fiscal year. In financial modeling, the accounts receivable turnover ratio (or turnover days) is an important assumption for driving the balance sheet forecast. Here’s how the formula looks when you enter the above values into the asset turnover ratio calculator:Ĭompany A’s Asset Turnover Ratio = $6.5 million / $3.75 million = 1.73 The average of the total assets are $3.75 million ( / 2). As we can see from the example above, asset turnover ratio with a value greater than 1 stands for high efficiency, because the value of the revenue is higher than the value of the assets used. Step 3: Calculate the asset turnover ratio.

The company’s total assets at the beginning of the year were $3 million and $1.5 million at the end of the fiscal year.

Security Reduce your liability when handling customer card data.įor this example, Company A has a total net sales of $6.5 million at the end of its fiscal year.Business Types Find solutions that fit the workflow of your business and industry.Features (All-Inclusive) 20+ features that simplify the payment collection process.It is generally calculated as a ratio by dividing a companys total sales revenue in a certain time period by the total value of its assets during that same period. Integration Marketplace → Accept payments inside 100+ accounting, ERP, CRM, and eCommerce tools. Net asset turnover is a financial measurement which is intended to gauge how well a company turns its assets into revenue.Accept Payments Accept credit, debit and eCheck payments across multiple channels.

0 kommentar(er)

0 kommentar(er)